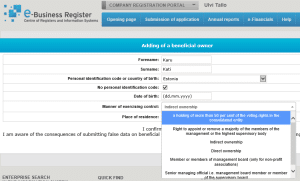

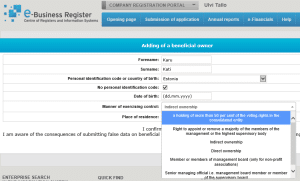

Dear members of the Board, adding Ultimate Beneficial Owners of company in Estonia (actual beneficiary) is quite easy when you have an ID card and you know your company’s structure.

How do I submit?

You log in to the entrepreneur’s portal

RIK and indicate the actual beneficiaries.

When do I submit the data about the actual beneficiary?

Data must be

submitted no later than by 31 October 2018. Data of the actual beneficiaries can be complemented in the entrepreneur’s portal database of the Business Register (e.g. add the method of control), then confirm the data and / or enter and add the actual beneficiaries themselves.

Who is an actual beneficiary?

A natural person who, by exploiting his or her influence, makes a transaction or operation or otherwise acquires control over a transaction, operation or other person and for whose interest, benefit, or behalf, a transaction or operation is performed.

In the case of a trading company, the main methods of control are:

- Direct ownership – A natural person owns more than 25 per cent of the company.

- Indirect ownership – A company controlled by a natural person owns more than 25 per cent of the company.

Involvement of less than 25 per cent is only shown if there is control over the company. You can find more detailed instructions

here.

Who does not have the obligation of submitting an actual beneficiary?

Apartment association;

building association;

affiliate;

stock company, that is subject to disclosure requirements or equivalent international standards in accordance with European Union law ensuring sufficient transparency of ownership information;

a foundation, whose economic activity is aimed at maintaining or collecting assets in the interests of the group of beneficiaries or persons specified in the statutes, and who have no other economic activity.

Editing, maintaining, and deleting data

Upon changes to the submitted data, the Board shall provide the updated data

within 30 days. The correctness of the actual beneficiaries’ data (i.e., if no changes have occurred) are confirmed by the Board every year when submitting the annual report. Failure to submit data of the actual beneficiary, failure to report changes to the data or submitting knowingly false information is punishable by a monetary fine. This means up to 300 fine units for a natural person and up to 32,000 euros for a legal entity. No enterprise will initially be penalised, these provisions will enter into force on

1 January 2019.

If you do not have an ID-card, please write to us at: info@grow.ee

Please note that an accountant does not have the rights to add actual beneficiaries.

We help you find the best solutions

Whatever the current laws may be, specialists in their area can find a solution to every problem. Accounting firm Grow is focusing on using innovative solutions and

it is not strange for us to think outside the box. If you have special requests that seem to be initially intricate,

contact us and we will find a solution together.