Kallid juhatuse liikmed, tegeliku kasusaaja lisamine on suhteliselt lihtne, kui tead oma ettevõtte struktuuri.

Kuidas esitada?

Logid ettevõtja portaali

RIK ja määrad tegelikud kasusaajad.

Millal tegeliku kasusaaja andmeid esitada?

Andmed tuleb

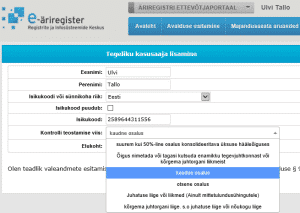

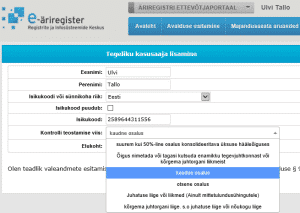

esitada hiljemalt 31.10.2018. Äriregistri ettevõtjaportaalis saab eeltäidetud tegelike kasusaajate andmeid täiendada (nt lisada juurde kontrolli teostamise viis), seejärel andmed kinnitada ja/või tegelikke kasusaajaid ise sisestada ning juurde lisada.

Kes on tegelik kasusaaja?

Füüsiline isik, kes teeb oma mõju ära kasutades tehingu või toimingu või omandab muul viisil kontrolli tehingu, toimingu või teise isiku üle ja kelle huvides, kasuks või arvel tehing või toiming tehakse.

Äriühingu puhul on kontrolli teostamise peamisteks viisideks:

- Otsene omamine – füüsiline isik omab äriühingus üle 25% suurust osalust.

- Kaudne omamine– äriühing, mis on füüsilise isiku kontrolli all, omab äriühingus üle 25% suurust osalust.

Kellel puudub tegeliku kasusaaja andmete esitamise kohustust?

- Korteriühistul;

- hooneühistul

- filiaalil

- börsiettevõttel, millele kohaldatakse Euroopa Liidu õigusega kooskõlas olevaid avalikustamisnõudeid või samaväärseid rahvusvahelisi standardeid, millega tagatakse omanikke käsitleva teabe piisav läbipaistvus;

- sihtasutusel, kelle majandustegevuse eesmärk on põhikirjas määratud soodustatud isikute või isikute ringi huvides vara hoidmine või kogumine ja kellel puudub muu majandustegevus.

Alla 25% osalusi näidatakse vaid siis kui omatakse kontrolli ettevõtte üle. Täpsema juhendi leiad

siit.

Andmete muutmine, säilitamine ja kustutamine

Tegelikke kasusaajaid tuvastamist puudutavates

sisulistes küsimustes võite pöörduda Rahandusministeeriumi ettevõtluse ja arvestuspoliitika osakonna juristi Ülle Eelmaa poole, telefonil teel 611 3016 või kirjalikult

ylle.eelmaa@fin.ee.

Juhime tähelepanu, et raamatupidajal puuduvad õigused tegelike kasusaajate andmete lisamiseks.

Esitatud andmete muutumisel esitab juhatus

30 päeva jooksul õiged andmed. Tegelike kasusaajate andmete õigsust (s.o kui muudatusi pole toimunud) kinnitab juhatus igal aastal majandusaasta aruande esitamisel. Tegeliku kasusaaja andmete esitamata jätmise, andmete muutumisest teatamata jätmise või teadvalt valeandmete esitamise eest, on ette nähtud karistus rahatrahvi näol. Selleks on kuni 300 trahviühikut füüsilise isiku puhul ja kuni 32000 eurot juriidilise isiku puhul. Ühtki ettevõtjat esialgu karistama ei hakata, need sätted jõustuvad

1. jaanuarist 2019.

Aitame parimad lahendused üles leida. Olgu praegu kehtivad seadused milliseid tahes, oma ala spetsialistid suudavad siiski igale murele lahenduse leida. Raamatupidamisbüroo Grow on suunatud innovaatiliste lahenduste kasutamisele ja

meile ei ole võõras raamidest väljaspool mõtlemine. Kui sul on esialgu keerukana tunduvaid erisoove,

võta meiega ühendust ja leiame üheskoos lahenduse.