MANDATORY REQUIREMENTS FOR INVOICES

According to § 7 of the Accounting Act (hereinafter referred to as the Accounting Act), the following data must be reflected on the source document (applies to source documents from which input VAT cannot be deducted):

- time of occurrence;

- the economic substance of the transaction;

- transaction figures (quantity, price, amount);

- invoice number or other identification number;

- Data that allows the identification of the transaction parties (Seller and Buyer).

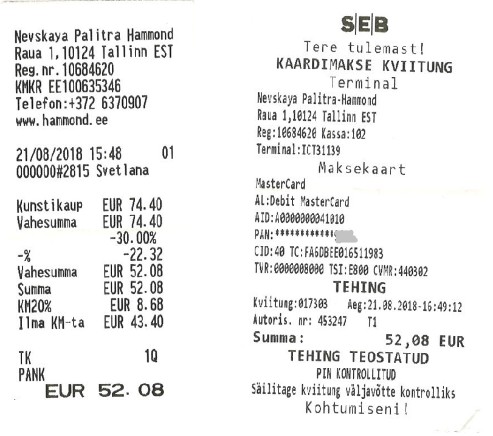

Example: most common purchases:

- shop check;

- a receipt from a gas station;

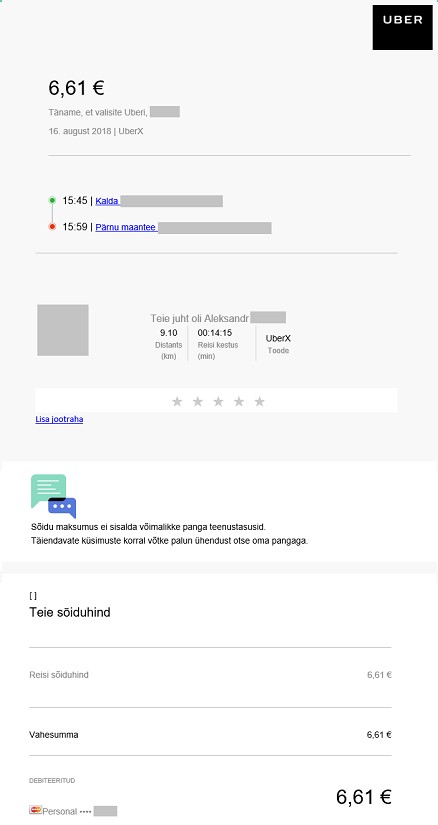

- taxi ride driven with a mobile app;

- other purchase invoices,

... contain the time of payment, the content of the transaction, the amount and other references, but none of them indicate who directly owns the expense (the buyer's name). If the buyer's name is missing in the case of a simplified invoice, the original document does not sufficiently prove the expense to the company's name and it must be added to the document by hand (in the case of an electronic document, before taking a picture). If the proof is not sufficient, the original document is considered an expense not related to the company and is subject to income tax.

Often, the invoice is also missing an identification code (e.g. invoice number).

The image shows that there is a date, amount, and economic content, but the buyer's name is missing. This document is not sufficient to prove that it is a company-related expense. In this example, it can be made sufficient by writing the company name by hand.

To save time, you can use a stamp with company information instead of writing by hand.

NB! The picture shows both a store receipt and a card payment receipt. A card payment receipt alone is not sufficient because it has no economic content.

The taxi receipt on the right is also not sufficient proof. In principle, there is economic content, but the buyer is the first name of the service user, but it is not mentioned which company he is an employee of. The receipt also lacks an invoice number.

This statement cannot be made compliant, it will be taxed in any case.

You can read more about transaction verification here.

If the invoice includes VAT (provided by the VAT payer), then there are more valid requirements for the original document. The requirements are: Based on Section 37 of the Estonian Tax Code, the following must be noted on the invoice:

1. invoice serial number and date of issue;

2. name, address, tax registration number of the taxable person;

3. name and address of the purchaser of the goods or recipient of the service;

4. the tax registration number of the purchaser of the goods or recipient of the service, if he or she has a tax liability upon purchasing the goods or receiving the service;

5. name or description of the goods or services;

6. quantity of goods or volume of service;

7. the date of delivery of the goods or provision of the service or the date of receipt of partial or full payment for the goods or service, if this is determinable and different from the date of issue of the invoice;

8. the price of the goods or services excluding VAT and any discount if it is not included in the price;

9. taxable amount by VAT rate, together with the applicable VAT rates, or the amount of tax-free turnover;

10. the amount of VAT payable (in euros), except in cases provided for by law.