Laskun pakolliset kentät

Laskuilla, jotka eivät sisällä vähennyskelpoista arvonlisäveroa, on seuraavat vaatimukset. Kirjanpitolain § 7 mukaan lähdeasiakirjan on sisällettävä seuraavat tiedot (koskee lähdeasiakirjoja, joista ei voi vähentää ostoihin sisältyvää arvonlisäveroa):

- asiakirjan laatimispäivämäärä;

- liiketoimen taloudellinen sisältö;

- asiakirjan nimi ja numero;

- tapahtumaan liittyvät luvut (määrä, hinta ja kokonaissumma);

- kaupan osapuolten (myyjän ja ostajan) tunnistetiedot.

Esimerkkejä yleisimmistä ostoksista:

- kuitti myymälästä;

- kuitti automaattiselta huoltoasemalta;

- mobiilisovelluksen kautta maksettu taksimatka;

- muita laskuja erilaisista ostoksista.

Nämä sisältävät maksuajankohdan, tapahtuman sisällön, summan ja muita viitteitä, mutta missään niistä ei ole merkintää siitä, kenelle kustannukset kuuluvat (ei ostajan nimeä). Jos yksinkertaistetusta laskusta puuttuu ostajan nimi, lähdedokumentti ei riitä todistamaan, että kustannukset liittyvät liiketoimintaan, ja yrityksen nimi on kirjoitettava käsin kuittiin (sähköisessä asiakirjassa ennen kuvan ottamista). Jos todiste ei riitä, asiakirjaa pidetään liiketoimintaan liittymättömänä ja se verotetaan tuloverolla.

Usein tällaisista asiakirjoista puuttuu myös tunnistenumero (esim. laskun numero).

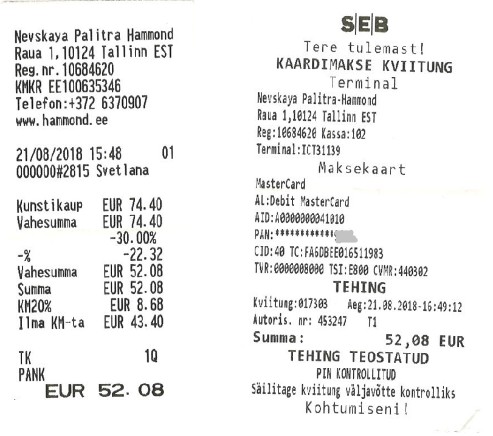

Kuten kuvasta näkyy, siinä on päivämäärä, summa ja tapahtuman sisältö, mutta ei nimeä.

ostajan. Tämä asiakirja ei riitä todistamaan suhdetta liiketoimintaan. Se voidaan muuttaa riittäväksi asiakirjaksi kirjoittamalla siihen yrityksen nimi.

Ajan säästämiseksi voidaan harkita yrityksen tiedoilla varustetun temppelin/leiman käyttöä.

Huom! Kuvassa on myymälän kuitti (vasemmalla) ja korttimaksukuitti (oikealla).

Pelkkä korttimaksukuitti ei riitä, koska tapahtumalla ei ole taloudellista merkitystä.

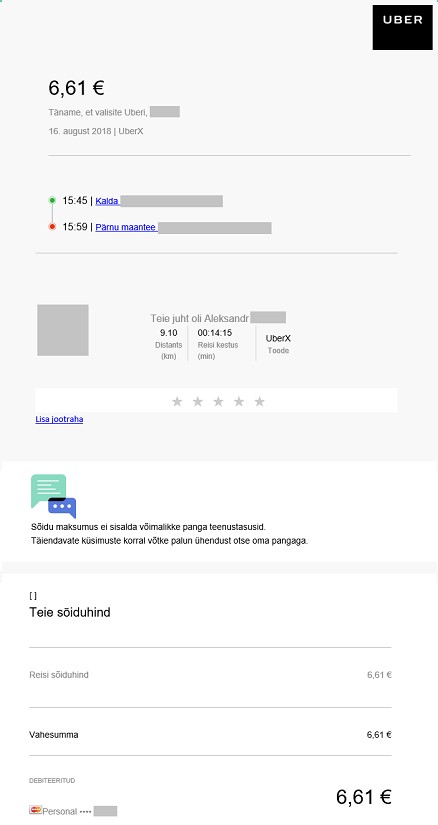

Tämä on esimerkki taksimatkan kuitista, joka ei ole asianmukainen lähdeasiakirja. Vaikka tapahtuman taloudellinen sisältö on olemassa, asiakirjasta puuttuu yrityksen tiedot, jotka ovat ensisijaisesti vaaditut tiedot. Kuitissa ei myöskään ole laskun numeroa.

Tätä kuittia ei ole mahdollista tehdä oikein, joten siitä peritään vero.

Lisätietoja varten voit lukea tarkemmin täältä.

Jos lasku sisältää arvonlisäveron (jonka on antanut arvonlisäverovelvollinen), sovelletaan seuraavia sääntöjä:

ALV-lain § 37 mukaan laskussa on ilmoitettava seuraavat tiedot:

- laskun sarjanumero ja kirjoituspäivämäärä;

- verovelvollisen nimi ja osoite sekä henkilön verovelvollisen rekisteröintinumero (ALV-numero);

- tavaroiden hankkijan tai palvelujen vastaanottajan nimi ja osoite;

- tavaroiden hankkijan tai palvelujen vastaanottajan verovelvollisen rekisteröintinumero, jos tavaroiden hankkijalla tai palvelujen vastaanottajalla on verovelvoitteita tavaroiden hankinnan tai palvelujen vastaanottamisen yhteydessä;

- tavaroiden tai palveluiden nimi tai kuvaus;

- tavaroiden määrä tai palveluiden laajuus;

- tavaroiden lähetyspäivä tai palvelujen suorittamispäivä tai tavaroiden tai palveluiden täyden tai osittaisen maksun vastaanottamispäivä, jos päivämäärä on määritettävissä ja se poikkeaa laskun kirjoittamispäivästä;

- tavaroiden tai palveluiden hinta ilman arvonlisäveroa ja mahdolliset alennukset, jos ne eivät sisälly hintaan;

- verotettava määrä eriteltynä eri arvonlisäverokantojen mukaan sekä sovellettavat arvonlisäverokannat tai verovapaan luovutuksen määrä;

- maksettavan arvonlisäveron määrä, lukuun ottamatta laissa säädettyjä poikkeuksia. Arvonlisäveron määrä ilmoitetaan euroina.