Dear Board Members, Adding a beneficial owner is relatively easy if you know your company structure.

How to submit?

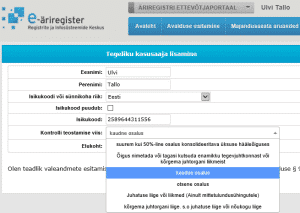

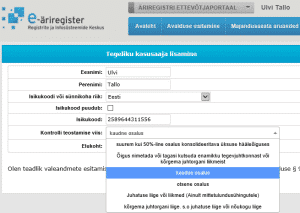

You log into the entrepreneur's portal

RIK and you designate the beneficial owners.

When to submit beneficial owner information?

The data will come

to be submitted no later than 31.10.2018. In the enterprise portal of the business register, you can supplement the pre-filled beneficial owners' data (e.g. add the way of performing the inspection), then confirm the data and/or enter and add the beneficial owners yourself.

Who is the real beneficiary?

A natural person who makes a transaction or action using his influence or otherwise acquires control over a transaction, action or other person and in whose interest, benefit or account the transaction or action is carried out.

In the case of a company, the main ways of performing control are:

- Direct possession – a natural person owns a stake of more than 25% in the company.

- Indirect possession– the company, which is under the control of a natural person, has a stake in the company of more than 25%.

Who does not have the obligation to provide the details of the beneficial owner?

- At the apartment association;

- at the building society

- at the branch

- at a listed company, subject to disclosure requirements consistent with European Union law or equivalent international standards that ensure adequate transparency of information about owners;

- at the foundation, whose purpose of economic activity is to keep or accumulate property for the benefit of beneficiaries or a circle of persons specified in the articles of association and who have no other economic activity.

Holdings under 25% are shown only when controlling the company. You can find a more detailed guide

siit.

Modification, storage and deletion of data

Regarding identification of beneficial owners

in matters of substance you can contact Ülle Eelmaa, a lawyer at the Business and Accounting Policy Department of the Ministry of Finance, by phone at 611 3016 or in writing

ylle.eelmaa@fin.ee.

Please note that the accountant does not have rights to add the data of the actual beneficiaries.

In case of changes in the submitted data, the board shall submit

in 30 days correct data. The correctness of the actual beneficiary data (ie, if no changes have taken place) is confirmed by the board every year when submitting the annual report. Failure to provide data on the actual beneficiary, failure to report changes in data, or knowingly providing false information is punishable by a fine. For this purpose, there are up to 300 fine units in the case of a natural person and up to 32,000 euros in the case of a legal entity. No entrepreneur will be penalized for the time being, these provisions will enter into force

From January 1, 2019.

We help to find the best solutions. Olgu praegu kehtivad seadused milliseid tahes, oma ala spetsialistid suudavad siiski igale murele lahenduse leida. Raamatupidamisbüroo Grow on suunatud innovaatiliste lahenduste kasutamisele ja

meile ei ole võõras raamidest väljaspool mõtlemine. Kui sul on esialgu keerukana tunduvaid erisoove,

võta meiega ühendust ja leiame üheskoos lahenduse.