Early communication with an accountant will help avoid surprises and find better solutions for your business.

Author Archives: Grow EE

Dividends received from an Estonian company with a holding of less than 101% may result in double taxation.

A cyber attack doesn't start with the server, it starts with the leader. Be aware of the simple steps that will protect your business.

Crypto assets are treated as financial assets in Estonia, profits are declared and taxed.

Download a table with information on the calendar working hours fund for 2026.

From 2026, a tax-free income of €700 per month will apply to all working-age people, the tax bracket will disappear, and the income tax will remain at €221.3T.

An interim chief accountant keeps financial management stable at critical moments.

Artificial intelligence is changing accounting: less manual labor, more precision and strategy.

Gross salary ensures clarity and stability, net salary brings risks and confusion. In Estonia, gross salary is always agreed upon.

Read how to avoid the main obstacles and what strategies will help you grow your e-business faster!

A leadership gap doesn't have to mean risk – an interim CFO brings stability and strategy.

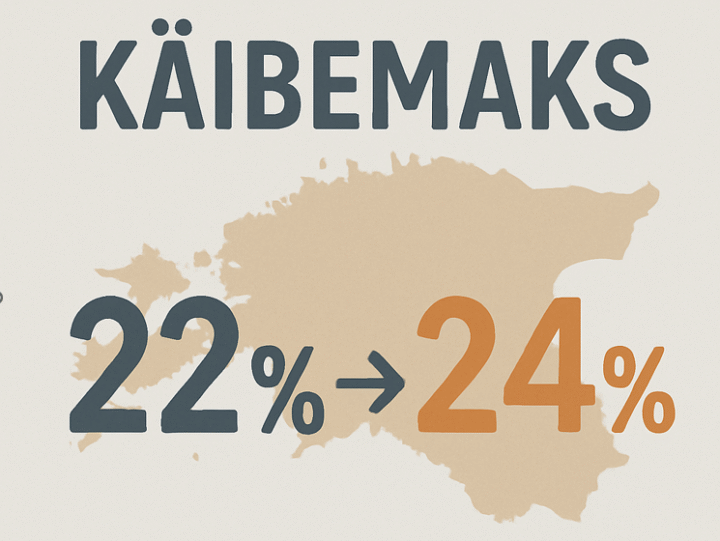

Tax changes are shaking up Estonian business and everyday life. A new blog will help you stay up to date with the changes,

Grow your business smartly – equity financing brings investors' knowledge, contacts, and strategic perspective.

Values and humanity create a culture where everyone dares to be themselves.

Ulvi Tallo's impressions from the GGI European conference in Marbella: digitalization, collaboration, and a freshness of thought that lasts longer than any photograph.

The government decided to make the VAT increase permanent, which means that the current temporary tax increase will remain in effect indefinitely.

- 1

- 2